Looking to Automate? Payment Gateway Integration Can Help!

In today’s digital world, businesses must ensure that their payment systems are not only secure but also efficient and user-friendly. Whether you’re running an e-commerce store or a booking platform, right payment gateway integration is critical to providing a seamless customer experience. This article explores the importance of payment gateways, how they work, and why integrating them effectively is essential for your business’s success.

Table of Contents

The Role of Payment Gateways in Digital Transactions

Payment gateways are the backbone of online transactions, acting as a mediator between customers and businesses. They authorize payments, ensure data security, and provide a smooth transaction process. By handling the intricate details of transferring funds from the customer’s account to the merchant’s, payment gateways simplify the purchase process, making it easier for customers to complete their transactions.

How Payment Gateways Work

When a customer makes a purchase online, the payment gateway encrypts the transaction details, including credit card information, and sends it to the acquiring bank. The bank then processes the transaction, either approving or declining it based on the customer’s available funds and fraud checks. The payment gateway communicates this result back to the business, which completes the transaction.

Importance of Payment Gateway Integration

- Security and Trust: A secure payment gateway is vital for protecting sensitive customer data, such as credit card details, from cyber threats. By ensuring transactions are encrypted and compliant with industry standards like PCI DSS, businesses build trust with their customers.

- Efficiency in Transactions: Efficient payment processing means quicker, smoother transactions, reducing the chances of cart abandonment. Customers are more likely to complete their purchases when the payment process is hassle-free.

- Customer Satisfaction: Offering multiple payment options and ensuring a secure transaction process enhances customer satisfaction. A positive payment experience encourages repeat business and fosters brand loyalty.

- Global Reach: Payment gateways that support multi-currency transactions allow businesses to expand globally, reaching customers in different regions without worrying about currency conversion or international transaction issues.

Key Features of Effective Payment Gateways

Choosing the right payment gateway for your business involves understanding the features that contribute to a secure and efficient payment process.

1. Data Encryption and Security

Data encryption ensures that sensitive information, like credit card numbers, is securely transmitted during the transaction process. Look for gateways that offer SSL encryption and comply with PCI DSS (Payment Card Industry Data Security Standard) to protect against data breaches and fraud.

2. Multi-Currency Support

For businesses with a global customer base, multi-currency support is essential. It allows customers to pay in their preferred currency, reducing friction in the purchasing process and minimizing exchange rate issues.

3. Fraud Detection and Prevention

Advanced payment gateways incorporate fraud detection tools that monitor transactions for suspicious activity. These tools use algorithms and machine learning to identify potential fraud, preventing chargebacks and protecting both the customer and the business.

4. Mobile Optimization

With the rise of mobile commerce, it’s crucial that payment gateways are optimized for mobile devices. A mobile-friendly payment process ensures that customers can complete transactions seamlessly, regardless of the device they’re using.

5. Integration with Existing Systems

Your payment gateway should integrate smoothly with your existing e-commerce or booking platform. Whether you use a CMS like WordPress or a custom-built site, the payment gateway should support easy integration, ensuring a seamless user experience.

Impact of Payment Gateways on Customer Satisfaction

Customer satisfaction is directly linked to the efficiency and security of your payment system. A well-integrated payment gateway can significantly enhance the customer experience in several ways:

1. Reducing Cart Abandonment

Cart abandonment is a major issue in e-commerce. Complicated or lengthy payment processes can cause customers to abandon their carts before completing a purchase. By offering a streamlined, user-friendly payment process, you can reduce cart abandonment rates and increase conversions.

2. Building Trust and Loyalty

Customers are more likely to trust and return to a business that provides secure payment options. Displaying security badges and offering multiple, reputable payment methods can reassure customers that their data is safe, building long-term loyalty.

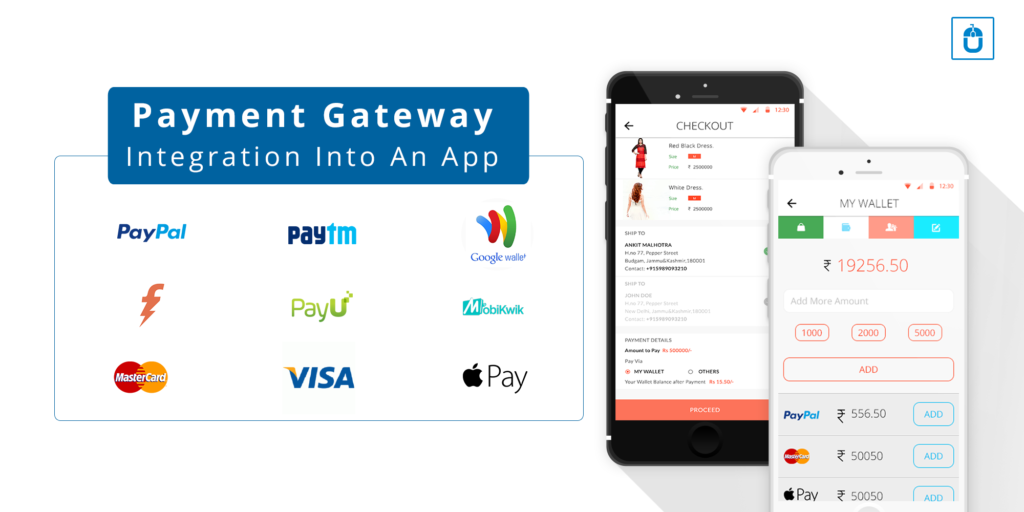

3. Offering Diverse Payment Options

Different customers prefer different payment methods, whether it’s credit/debit cards, digital wallets, or bank transfers. Providing a variety of payment options caters to a wider audience and enhances customer convenience, which is crucial for satisfaction and retention.

Challenges in Payment Gateway Integration

While integrating a payment gateway offers numerous benefits, it also comes with challenges that businesses must navigate carefully.

1. Regulatory Compliance

Compliance with financial regulations such as PCI DSS is non-negotiable. Failure to comply can result in hefty fines and damage to your business’s reputation. It’s important to choose a payment gateway that meets all regulatory requirements and to stay updated on any changes in legislation.

2. Security Risks

Even with advanced security measures, the risk of cyber threats remains. Businesses must implement additional security layers, such as two-factor authentication and regular security audits, to protect customer data and ensure transaction security.

3. Technical Integration

Integrating a payment gateway into your existing systems can be technically challenging, especially for businesses with custom-built platforms. It requires careful planning and possibly the assistance of a developer to ensure smooth integration and functionality.

4. Handling Chargebacks

Chargebacks occur when customers dispute a transaction and request a refund from their bank. Managing chargebacks can be complex and time-consuming, requiring a clear understanding of payment gateway policies and effective dispute resolution processes.

Best Practices for Payment Gateway Integration

To maximize the benefits of your payment gateway, it’s important to follow best practices during the integration process.

1. Choose the Right Gateway for Your Needs

Assess your business’s specific needs, including transaction volume, customer preferences, and geographic reach. Choose a gateway that aligns with these needs and offers features that enhance the customer experience.

2. Prioritize Security

Ensure that your chosen payment gateway complies with PCI DSS and offers robust encryption and fraud detection features. Regularly audit your payment processes to identify and address potential vulnerabilities.

3. Test Thoroughly Before Launching

Before going live, conduct thorough testing of the payment gateway to ensure it works seamlessly across all platforms and devices. Test different scenarios, including transaction success, failure, and chargebacks, to ensure your system can handle them effectively.

4. Provide Clear Communication

Keep customers informed throughout the payment process with clear, concise instructions and confirmations. Use email notifications to confirm payments and provide receipts, helping to build trust and transparency.

Conclusion

Integrating a secure and efficient payment gateway is essential for any business that wants to succeed in today’s digital economy. From enhancing customer satisfaction to boosting conversion rates, the benefits are clear. However, businesses must carefully choose the right gateway, prioritize security, and follow best practices to fully realize these advantages.

As online transactions continue to grow, the need for seamless and secure payment processes will only increase. By investing in a robust payment gateway integration, businesses can not only meet current customer expectations but also position themselves for future success in an increasingly competitive market.

However, navigating the complexities of payment gateway integration can be challenging. This is where Inflancer Technology comes into play. Inflancer offers cutting-edge solutions tailored to meet your specific business needs. With expertise in developing and integrating advanced payment systems, Inflancer ensures your transactions are secure, efficient, and optimized for the best user experience. By partnering with Inflancer, businesses can confidently enhance their payment processes, stay ahead of the competition, and focus on what they do best—growing their business.